Advanced Fraud Protection for SMB Lending

SMB lending is valued at $1 trillion+ and counting. That’s why fraudsters keep thinking of new ways to target it. Lynx is the prevention you need.

How Lynx prevents fraud

How small business lending fraud is identified and prevented with Lynx.

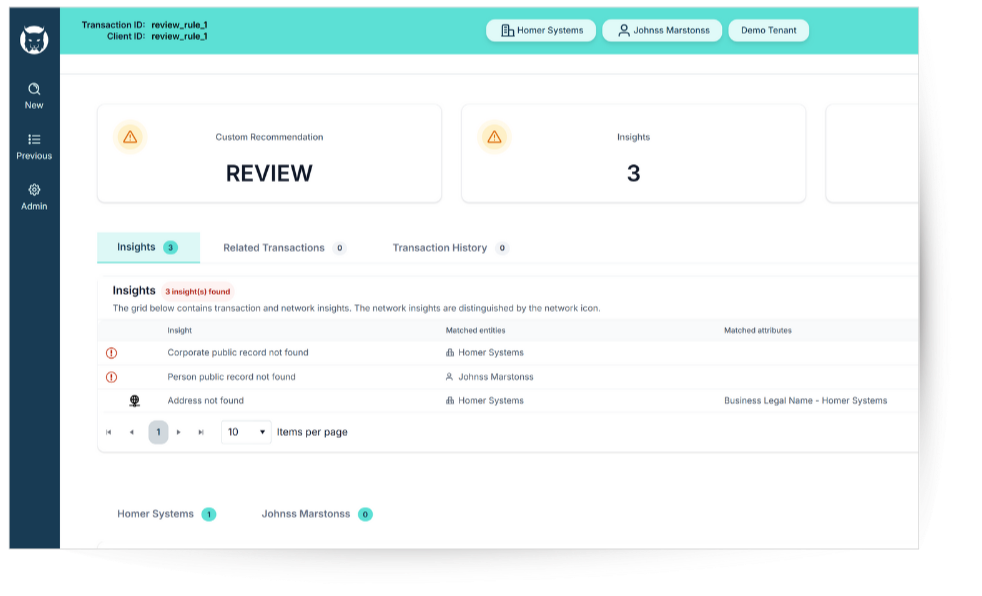

- When an application is received, Lynx analyzes and standardizes data and AI tools instantly identify and scan supporting documents.

- Your data, network data and 3rd party integrations validate the applicant's ID and conduct KYB and KYC.

- Customized AI algorithms spot fraud patterns across data sources in real-time.

- In seconds, Lynx shows Pass, Fail, or Review plus custom insights to weed out fraudulent applications so you can focus on legitimate ones.

Without Lynx

⚠️ Fraud is caught after funds are disbursed, leading to costly write-offs

⚠️ Manual reviews slow down decisioning and increase operational overhead

⚠️ Reliance on limited data makes synthetic and stolen identities harder to catch

⚠️ Siloed data misses fraud patterns

With Lynx

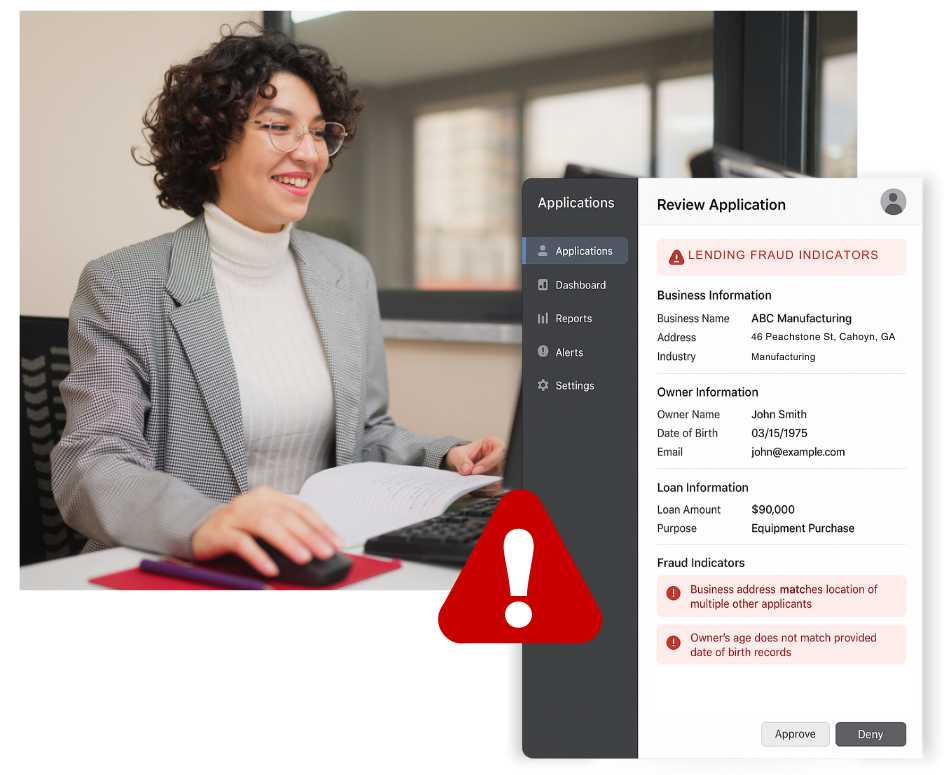

✅ Fraud is flagged before loans approved, protecting your portfolio and helping to prevent losses

✅ Automated fraud detection works in real-time, keeping origination fast and efficient

✅ Lynx minimizes fraud-related losses, protecting profitability and freeing up resources for growth

✅ Data orchestration and cross referencing spots fraud

Yes, small business lending is different. So is small business lending fraud.

We should know. As a pioneer in SMB lending, when we couldn’t find a product sophisticated enough to catch the unique patterns in small business fraud, we built our own.

Is your institution using a fraud prevention solution built specifically to catch SMB lending fraud?

Fraud is on the rise. Let's dive into what that looks like.

-

SMB Fraud is Growing

-

Fraud is Caught Too Late

-

Identity Theft is the Top Threat

-

Digital Channels = Fraud Frontier

In fact, fraud is growing faster than lending.

Each year fraud rates rise at double-digit levels, outpacing the growth of the lending industry itself. While lenders work to expand their portfolios responsibly, criminals innovate even faster—scaling their schemes in ways that threaten revenue, compliance, and customer trust. Left unchecked, this widening gap creates a costly and unsustainable risk environment.

More than 70% of fraud is caught only after a loan has been issued.

That means financial institutions are absorbing preventable losses while also burdening teams with costly investigations and write-offs. Early detection isn’t just a best practice—it’s the only way to protect margins and keep fraudulent accounts out of the pipeline.

Stealing or fabricating personal and/or business identities is the most common method.

The most common tactic used by bad actors is deceptively simple: stealing or fabricating personal or business identities. Fraudsters create convincing false profiles or manipulate real data to bypass loan onboarding systems. With synthetic identities on the rise, traditional verification methods are no longer enough to safeguard lenders against these increasingly sophisticated attacks.

More than 80% of lending fraud events occur via digital channels.

As lenders digitize more of their customer journey, from applications to approvals, to meet customer expectations and stay ahead of the competition, fraudsters exploit the convenience and speed of these online platforms. Apps, portals, and automated systems must be fortified with advanced fraud detection tools capable of identifying anomalies in real-time.

Lynx keeps your lending moving at the speed of business

Single API for Easy Installation

Lynx connects to your onboarding and decisioning systems via a single API.

Upload Your Historical Data

Upload past application, transaction, and interaction data for Lynx to clean, organize and use to identify fraud patterns.

Customize Your Rules

Leverage 40+ installed indicators and add your own to customize Lynx to your onboarding rules and workflows.