Lending Solutions,

Risk Solutions,

Fraud Solutions.

Built by Lenders, for Lenders.

Rapid's technology solutions help SMB lenders grow confidently. Since 2005, over 1,000 lenders and partners have trusted our technology and support to build strong portfolios.

Lenders can start, grow and protect SMB lending programs with confidence

Start Confidently

Start a risk-free SMB lending program. Say 'yes' more often to your clients.

Unlock New Income

Grow your SMB lending portfolio and unlock non-interest income.

Protect Your Growth

Identify lending risk and fraud with AI-powered tools, protecting your institution's growth.

Scale Flexibly

Scale up your lending program with 30+ integrations to partners and third-party sources.

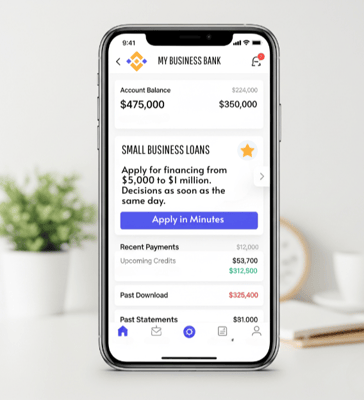

Embedded Lending

- Seamlessly integrate lending into your platform with our low-code solution

- Retain sticky SMB clients' deposits

- Leverage our balance sheet—or yours—to serve more businesses

OUR ADVANTAGE: With the largest network of trusted SMBs funders, we help your clients hear "yes" more often.

Small Business Loan Origination System

- Automate loan applications with advanced decisioning

- Streamline lending with editable, automated workflows

- Refer unserved applicants with a single click to our Funding Network

OUR ADVANTAGE: Earn non-interest income on borrowers you can't serve.

AI-Powered SMB Lending Fraud Prevention

- Connect third-party and internal data for a 360° customer view

- Proactively stop fraud before it impacts your portfolio with AI

- Leverage a Trusted Network to stay ahead of fraudsters

OUR ADVANTAGE: Purpose-built for SMB lending, Lynx detects the nuanced fraud and risk signals others often miss.

No video selected

Select a video type in the sidebar.

Powerful Partnerships for Every Lending Need

- Integration Partners: Embed our fintech tools directly into your platform

- Sales Partners: Resell or bundle our solutions with your offerings

- Solution Providers: Help SMB clients integrate & optimize their fintech stack

- Innovation Leaders: Co-create new SMB lending solutions

OUR ADVANTAGE: Since 2005, we’ve powered businesses with lending solutions and built trusted partnerships with 1,000+ organizations. Simply put—we offer a partnership for every need.

>25M

applications

processed via Rapid Finance's small business loan platforms

$5B

US dollars

delivered in growth capital to help small businesses start, scale, and succeed

20+

years

of proven lending experience, empowering both borrowers and partners to thrive