Small Business Embedded Lending Made Simple & Risk-Free

Offer your customers seamless access to fast, flexible financing—without the complexity of running a lending program yourself.

Launch an Embedded Lending experience

A better way to serve your small business clients with lending solutions.

- Launch embedded lending: Deliver a seamless, white-labeled SMB lending experience from first click to funding.

-

Expand your offerings: Serve small business clients with lending solutions—without building an in-house operation.

-

Monetize referrals: Unlock a new revenue channel by sending SMB clients to trusted lending partners.

-

Improve loyalty: Strengthen SMB client relationships by solving more of their financing needs.

-

Stay competitive: Offer a fully digital financing application experience that meets modern expectations.

Two decades of leadership in small business lending

With more than 20 years of experience, we bring the expertise and partnership your institution needs to grow lending through a seamless Embedded Lending program.

- $5B+ deployed: Tens of thousands of small businesses funded across diverse industries since 2005

- 1,200+ partners: Proven collaboration with organizations nationwide

- Trusted reputation: Known for speed, flexibility, and service that build lasting relationships

Rapid’s pre-built Embedded Finance integration with Q2’s Digital Banking Platform

For Q2 member banks and credit unions, our Embedded Finance solution offers a seamless way to expand their SMB financing product offerings and say 'yes' to SMBs outside their credit box, without balance sheet risk. And these banks and credit unions can also generate referral revenue to boot!

From the Q2 Toolkit, these Q2 member banks can access our pre-built Embedded Lending integration, and with just a few clicks, offer their clients a wide range of SMB financing products.

Without Embedded Lending

⚠️ Lose business clients with unmet financing needs

⚠️ Miss out on revenue from declined referrals

⚠️ Face risk and IT complexity of building your own lending program

⚠️ Watch SMB clients turn to competitors for banking solutions

With Embedded Lending

✅ Offer SMB clients a seamless financing application

✅ Earn referral revenue with zero risk

✅ Deliver an on-brand lending experience directly in your platform

✅ Rely on Rapid for compliance, decisioning, and funding

Rapid's Embedded Lending program for SMBs

-

Seamless Referral Experience

-

Rapid Application & Decisioning

-

Zero Operational Burden

-

Twenty Years of SMB Trust

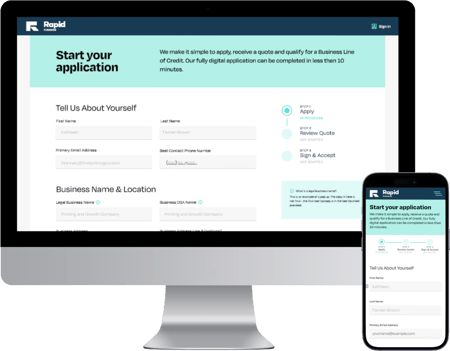

Launch a Secure Application Experience From Your Platform

Keep the process on-brand with a simple referral flow that directs customers to Rapid Finance for application, branded with your institution.

Earn from every qualified referral while Rapid Finance manages the application and funding.

Funding Decisions as Fast as Same Day

We manage assessment, approvals and funding quickly—so your small business clients get the working capital they need without delay.

No Need to Staff and Train for SMB Financing Needs

No need to build or staff a lending program for your small business clients. We handle the technology, compliance and all lending needs.

Twenty Years of Experience and Trust

For more than two decades, Rapid Finance has helped small businesses access the capital they need to grow. Today, we bring that proven expertise and trusted partnerships to power your embedded lending strategy with confidence.

Start an Embedded Lending program in weeks

Connect with Our Team

We help you determine which implementation is right for your and your SMB clients.

Set up Branded Referral Flow

With an easy-to-use API, we connect to your experience and create a branded application experience for your SMB clients.

Start Referring, Start Earning

Launch your program and offer your SMB clients small business financing options without financial risk or compliance burden.